Companies or firms, irrespective of the revenue generated profit/loss made during the financial year.If you meet the following criteria, then you must file Income Tax Return: Here are the ITR filing eligibility criteria.

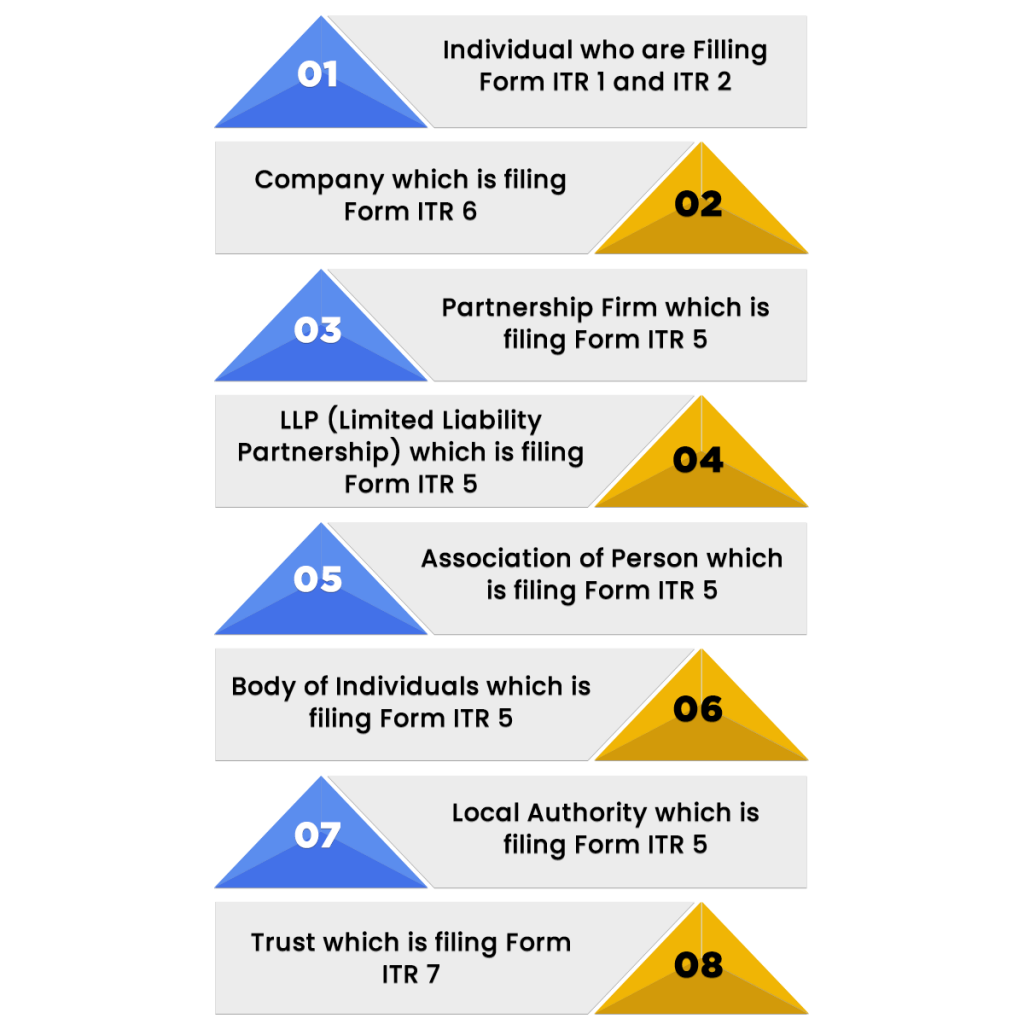

However, there are certain eligibility standards that should be kept in mind for a timely ITR filing. It is mandatory for individuals in India to file income tax returns. Who Can File ITR - Eligibility to File Income Tax Returns The Income Tax department has a set of seven different forms, namely ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6, and ITR 7. Anyone can file their ITR easily on the official portal of the Income Tax Department. Firms and companies, self-employed and salaried individuals, and HUFs (Hindu Undivided Families) must file an ITR form to the Income Tax Department of India.įiling an ITR is a procedure in which the taxpayer has to file a report for the gross income that has been earned by them during the financial year. It is a mandatory form that needs to be filed by individuals who draw a certain amount of money as earnings in business or employment. Income Tax Return (ITR) is a type of form used to declare an individual’s net tax liability, make claims for tax deductions, as well as report the total taxable income.

0 kommentar(er)

0 kommentar(er)